Title: Playing with F.I.R.E. How Far Would You Go for Financial Freedom?

Author: Scott Rieckens

Year: 2019

Back cover text:

What if a happier life was only a few simple choices away?

A successful entrepreneur living in Southern California, Scott Rieckens had built a ‘dream life’: a happy marriage, a two-year-old daughter, a membership to a boat club, and a BMW in the driveway. But underneath the surface, Scott was creatively stifled, depressed, and overworked trying to help pay for his family’s beach-town lifestyle. Then one day, Scott listened to a podcast interview that changed everything. Five months later, he had quit his job, convinced his family to leave their home, and cut their expenses in half. Follow Scott and his family as they devote everything to FIRE (financial independence retire early), a subculture obsessed with maximizing wealth and happiness. Filled with inspiring case studies and powerful advice.

Playing with FIRE is one family’s journey to acquire the one thing that money can’t buy: a simpler and happier life. Based on the documentary.

My Review

Stars (1/5):

Writing:

By reading Rich Dad, Poor Dad I had learned about devoting 10% of your income to Pay Yourself First. Which can then be invested. The F.I.R.E movement goes much further in pursuing financial independence: Cut your expenses radically. And invest the difference. In my opinion, the most important essence is shared immediately in chapter 1. And chapter 8, if you don’t know what an index fund is.

Does the book deliver (its title)?:

Yes, it follows the family in their journey to achieve F.I.R.E. And shows examples of how to do it.

Biggest take away/s:

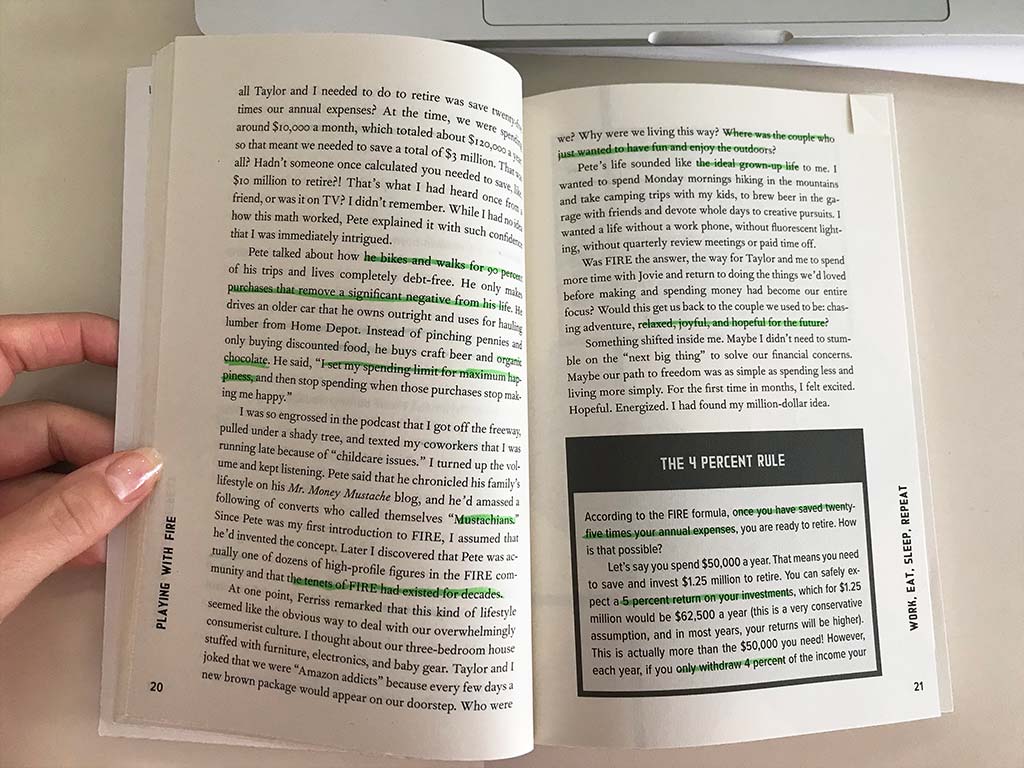

- FIRE formula: 1. Save your 25 x your annual expenses. 2. Invest that money in Vanguard index funds. 3. Only withdraw 4% (safe withdrawal rate).

- The secret to happiness. Socrates: Be happy with less. Confucius: Meditates upon good thoughts.

- Financial Independence (FI) is having the freedom and flexibility to pursue your true calling, whether or not it makes any money.

- FIRE path, save 50 to 70% of your income, invest in low-fee stock index funds (Vanguard), and retire in 10 years.

- Ideal income for emotional well-being is $60.000 to $75.000 (€51.268,50-€64.085,62)

- The FIRE community builds on the principles of openness and collaboration.

- Ten things exercise. What do you want to be doing with your time?

- Align what you want with how you spend.

- Retirement calculator⟶

- Gain a clear vision of what you want of this life.

- The big 3: Housing, transportation, and food.

- Life energy (the accusation of all the stuff around you). How much of your life is each purchase worth?

- Geo-arbitrage is the concept of relocating for lower costs of living.

- Conventional success is empty. What is your definition of success? Discover a life with more freedom, adventure, and fulfillment.

- Happiness is the only logical pursuit.

- Invest in the things that you value, like wellness, health, and mental fortitude. And skip the rest.

- Reorganize your life to fit your new goal.

Points of Improvement or Discussion:

The FI (Financial Independent) part of the FIRE- movement is mindful and empowering. With takeaways for low-income households too. But I am unsure if the RE (retire early) part of FIRE can work for all incomes. Because if you are already living frugally, because you do not have much income. Then there is no way to save 50 to 70% of your income.